Pole Barn Financing: How to Finance a Pole Building

Five Tips for a Smooth Experience

Pole barn homes, also called barndominiums, shed-homes, shouses or barn-homes, are gaining interest.

Are you among the many who are dreaming of building a large shop with attached living quarters? Did you know that it can be a struggle to find financing for your project?

Why? Because, pole barn homes aren’t yet as commonplace as conventionally built houses, so most lenders don’t understand how they’re built and are unwilling to risk financing something they’re unfamiliar with. What’s more, many lenders may receive only the sporadic pole barn house loan application and don’t have much opportunity to learn the nuances of post-frame construction.

Fortunately, securing financing doesn’t have to be a gloom and doom scenario. In fact, if you’re prepared with the right information and if you approach the right lender, applying for financing should be no different than seeking a traditional mortgage.

.jpg)

To start you on the right path, Alan Lierz, president of New Century Bank, offers the following five tips. Based in Manhattan, Kansas, New Century Bank specializes in pole barn home financing and provides mortgages and construction loans nationwide.

1. Interview Lenders

Before settling on any particular lender, interview several to learn whether they have experience issuing post-frame home mortgages, as well as construction loans. (Many financial institutions no longer offer residential construction loans as an after-effect of the 2007-08 financial crisis.) Furthermore, avoid lenders with separate residential construction and mortgage departments. “The mortgage department could give you a green light, while the construction loan officer may require a higher down payment or make other demands that can prevent you from moving forward,” Lierz explained. “It can be exhausting jumping through different hoops from two different departments within the same bank.”

2. Calculate Your Entire Project Cost

One of the best things you can do to enhance your chances of getting the loan, Lierz said, “is to calculate, to the best of your ability, the entire cost of the project, from land, utilities, site work, framing and finish.” Going to a banker without a well-thought-out plan, he added, “is not a good idea because banks are not in the business to take on risk; they’re into security, and not knowing something is not safe for a bank.”

3. Arm Your Lender with Plans

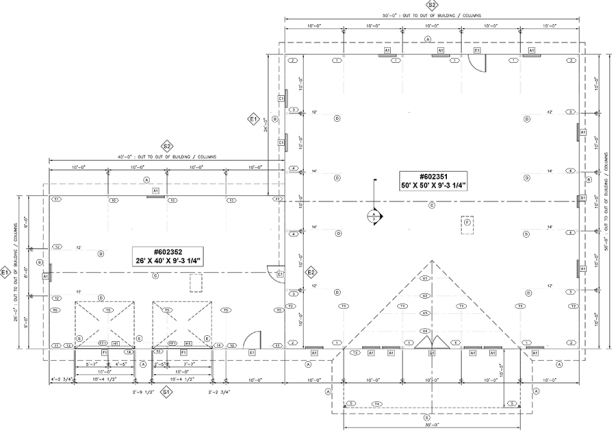

Similarly, equip your lender with your floor plan and elevation drawings. The more guesswork you can take away from their viewpoint, the more readily they can visualize your project and the more likely they’ll be friendlier toward your application.

4. Determine Your Capital Investment

Be prepared to fully articulate how much capital you plan to inject into the project. “Many clients will be vague and say, ‘as little as possible’,” Lierz said. “Much better to say: ‘I have this much capital, but I want to put in as little as possible.’ A banker will usually agree with the concept of ‘as little as possible,’ but they do have minimums.” Equally as important, be clear about how much of a monthly mortgage payment is good for your budget.

5. Make Sure Your Loan is Backed by Fannie Mae

If you need a mortgage that accommodates a modest income, be sure that your lender is backed by Fannie Mae. While it doesn’t provide loans directly, Fannie Mae buys and guarantees them in what’s known as the secondary mortgage market, thereby making more mortgages available to low- and moderate-income earners. Banks that are eligible to be backed by Fannie Mae also must agree to not practice unethical subprime lending practices.

“Post-frame residential construction offers a homeowner great quality and value, and the demand for them is growing exponentially,” Lierz concluded. “But they are definitely different than conventionally built houses. Buyers seeking pole barn home financing will do best with a lender that understands the product and can relay that understanding to appraisers and underwriters.”

For pole building home ideas, visit our photo gallery.

It’s easy to get started on your residential loan. Fill out a New Century Bank’s Construction Loan Application to get pre-approved.